Avalara named a Leader in four excerpts from the IDC MarketScape

Avalara named a Leader in tax compliance automation for enterprise, SMB, VAT, and e-invoicing

Introduction

Tax compliance has become increasingly complex as companies expand operations globally and digital transformation reshapes industries. Recent excerpts from the IDC MarketScape reveal how automation solutions help businesses meet these challenges.

Avalara was named a Leader in four excerpts, delivering powerful tax automation solutions to streamline processes, reduce risks, and enable smarter decision-making. Download your copy of the excerpts to learn more about why Avalara was named a Leader.

Download your excerpt

IDC opinion

The shift toward digital tax compliance is reshaping the business landscape. As such, businesses face increasing regulatory demands and the need for streamlined, automated solutions. This is especially true when it comes to automated sales and use tax solutions for both enterprise and SMB companies. Meanwhile, the transformation of the e-invoicing market in Europe has intensified the need for solutions to address e-invoicing mandates and value-added tax (VAT) compliance.

The IDC MarketScape named Avalara as a Leader in automated sales and use tax solutions for both enterprise and SMB companies.

“The complexity and volatility of e-invoicing regulations worldwide demand a single, comprehensive solution that can handle compliance across multiple countries. By adopting a solution that has wide coverage and integrates seamlessly with finance and ERP systems, businesses can not only stay compliant but also unlock opportunities to automate processes and improve efficiency.

Avalara E-Invoicing and Live Reporting offers a way for organizations to reduce the burden of e-invoicing compliance while streamlining their operations through one unified platform,” says Edyta Kosowska, Market Research Manager at IDC.

Key benefits of Avalara solutions

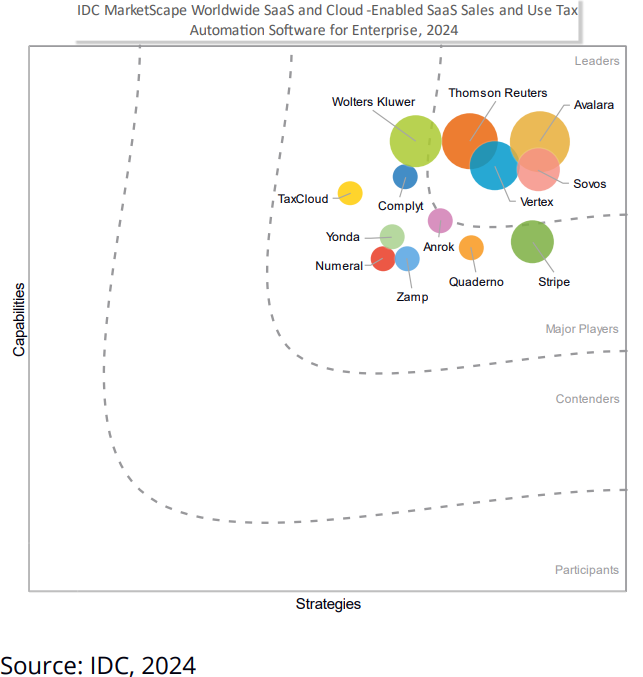

Avalara named a Leader in sales and use tax software for enterprise

“After a thorough evaluation of Avalara’s strategies and capabilities, IDC has positioned the company in the Leaders category in this 2024 IDC MarketScape for worldwide SaaS and cloud-enabled SaaS sales and use tax automation software for enterprise.”

—Kevin Permenter, Research Director, IDC

Why we believe Avalara is a Leader

We believe Avalara’s position as a Leader in the IDC MarketScape reflects its dedication to simplifying tax compliance through advanced technology and a customer-centric approach.

Key highlights of the excerpts

- Recognized as a Leader in SaaS and cloud-enabled sales and use tax automation for enterprise

- Provide end-to-end compliance for sales and use tax, helping businesses navigate complex regulations and streamline operations

- Feature a robust calculation engine for real-time tax determination and automated reporting

- Offer dynamic registration capabilities and a vast database of products to help ensure greater compliance across jurisdictions

- Recognized as a Leader in sales and use tax automation for small and midmarket businesses

- Offer a cloud-native compliance platform designed to simplify tax calculations, reporting, and filing

- Provide over 1,200 signed partner integrations with ERP, ecommerce, and financial systems, reducing setup time and ensuring streamlined automation

- Help SMBs navigate tax complexities, including economic nexus rules and multi-jurisdiction compliance

E-invoicing and live reporting

- Positioned as a Leader in European compliant e-invoicing solutions, supporting businesses across multiple countries

- Delivers a cloud-based platform with real-time invoice validation, digital signature capabilities, and automated submission to tax authorities

- Features a global API for streamlined ERP integration, helping to ensure greater compliance with evolving e-invoicing mandates

- Enables businesses to consolidate e-invoicing across multiple jurisdictions, reducing administrative burden and improving tax accuracy

- Simplifies global trade by automating tax processes for real-time compliance with local regulations

- Excels in VAT determination, electronic invoicing, and reporting functionalities

- Provides a single global API for integration and scalability, supporting diverse transaction types including intra-EU exports and imports

- Addresses the growing need for e-invoicing compliance around the world

Innovative features

- AI-driven tools for automating routine tasks, enhancing fraud detection, and improving data accuracy

- A comprehensive dashboard for monitoring compliance and generating actionable insights

About the IDC MarketScape excerpts

The IDC MarketScape excerpts serve as valuable resources for businesses aiming to modernize their tax compliance through digital solutions. These excerpts offer a comprehensive evaluation approach, which goes beyond market share to deliver a detailed evaluation of vendors. By evaluating vendors and their offerings, capabilities, strategies, and factors influencing both current performance and future success, the IDC MarketScape provides businesses with a clear framework for making informed decisions.

Download the excerpts to see why Avalara is a Leader

Ready to streamline your tax compliance process and gain a competitive edge? Download the different excerpts from the IDC MarketScape to learn more about Avalara solutions and how they can transform your compliance strategy.