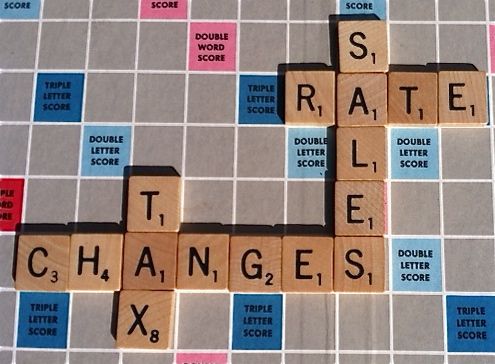

Sacramento Sales Tax Rate Change Reminder

- Jul 19, 2013 | Gail Cole

Sacramento, California State Board of Equalization (BOE) recently released a "City of Sacramento Tax Rate Increase" reminder.

The reminder notes that the rate of sales and use tax in the city limits is different from the rate of sales and use tax in unincorporated Sacramento County, which is 8%. Some type of address verification is required in order to "verify whether you or your product shipping locations are within the city limits."

Failure to charge the correct tax rate leads to problems. Customers get angry when they're overcharged. Cities, counties and states don't like it when they're shorted sales tax revenue, but they don't want businesses to over collect, either. Earlier this summer, a car rental business at the Sacramento airport was busted for charging customers the city rate of 8.5% when they only owed the 8% county rate. It was an error, but it still made headlines.

To avoid such errors in the future, business owners are advised to contact the BOE or visit the Sacramento County "Cities Within the County" webpage.

You can spend your time tracking down the right rate, or you can let someone else do the work for you. Finding the right sales tax rate isn't as straightforward as it might seem. Relying on zip codes can leave businesses with the wrong rate. Geolocation is more accurate.

Simplify your business. Simplify sales tax.

Get Free Tax Rate Tables