Colorado May Impose High Taxes on Recreational Marijuana

- Apr 8, 2013 | Gail Cole

For the states of Colorado and Washington, one of the most compelling reasons to legalize recreational marijuana was the sales tax revenue it would generate. To wit, Colorado’s Amendment 64 reads, “In the interest of the efficient use of law enforcement resources, enhancing revenue for public purposes, and individual freedom, the people of the State of Colorado find and declare that the use of marijuana should be legal for persons twenty-one years of age or older and taxed in a manner similar to alcohol.” (Emphasis mine). It follows, then, that the state would take great care in determining the rate of taxation for recreational marijuana.

Under Amendment 64, an “excise tax and application fees are expressly indicated….” The excise tax is capped at 15%, with the first $40 million promised to the public school capital construction assistance fund. Application fees are capped at $500. The Task Force expressed concern that “limitations on potential revenue could leave the new Marijuana Enforcement Division under-funded ….”

However, as the Task Force reminds in its report on the Implementation of Amendment 64, Amendment 64 does not comply with TABOR (Taxpayer Bill of Rights). In addition:

- “Voter approval of Amendment 64(5)(d) was not a vote for a tax increase that can be implemented and collected with the simple enactment of a tax statute by the General Assembly;” and

- “Another vote of the majority of the people of the State of Colorado is required, through a TABOR-compliant referendum or citizen initiative, to impose specific taxes on adult-use marijuana.”

Bearing this in mind, the Task Force made the following recommendations:

- That the General Assembly ask voters “to amend Title 39 of the Colorado Revised Statutes to provide for a new Article entitled ‘Marijuana Products Sales Tax.’”

- That a “robust new sales tax structure for marijuana products” be submitted to Colorado voters in the November 2013 state-wide election, to be effective if approved on January 1, 2014.

The Task Force could not agree on a sales tax rate for marijuana products, and instead invited the Colorado General Assembly to determine the rate, based on information gathered from state agencies and experts in the field.

Last week, The Denver Channel reported that state lawmakers “are considering a 40% sales tax for recreational marijuana.” That rate reflects the 15% excise tax, a 15% special tax, and state and local sales taxes that can be as high as 8%. As of this writing, Colorado has a state sales tax rate of 2.9%

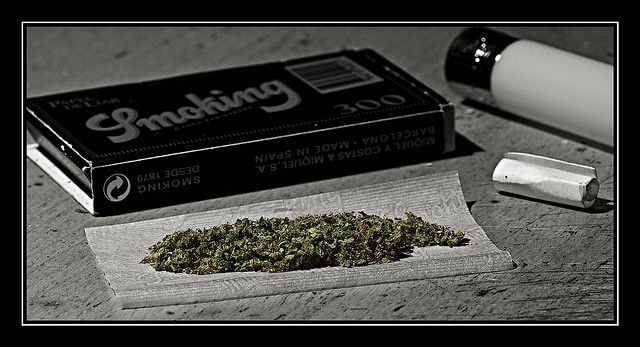

The Huffington Post reports that some state lawmakers are concerned that voters will reject such high taxes. Some are worried that, if approved, high taxes will encourage recreational marijuana users to purchase their weed on the black market, thereby robbing the state of its tax revenue. High taxes could also encourage pot smokers to grow their own marijuana. Under Amendment 64, adults are permitted to grow 6 plants.

Get Free Tax Rate Tables