W-9 forms in 2025: What are they and who needs them?

Income tax return requirements, tax identification numbers, and Internal Revenue Service (IRS) forms can get complicated quickly, especially if your business hires independent contractors or other nonemployees. In this blog post, we break down one of the common forms — the W-9 — and share tips on managing tax forms with automation.

What is a W-9 form?

When is a W-9 form required?

What’s the purpose of a W-9 form?

How to get a W-9 form

How to fill out a W-9 form

What do employers do with W-9 forms?

How can I more easily manage my employees’ W-2s and other tax forms?

What is a W-9 form?

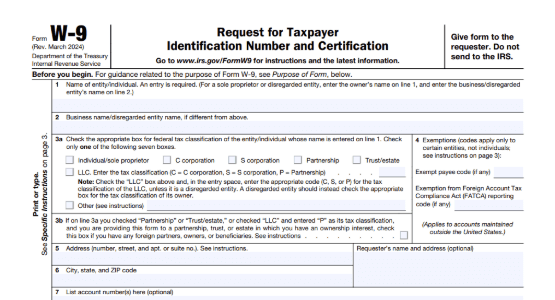

Formally called Request for Taxpayer Identification Number and Certification, the IRS Form W-9 is typically used by employers to verify information for a nonemployee individual receiving payments. The information on this form is used to generate a 1099 tax form.

In plain language, if your business hires contractors, freelancers, or vendors, you must collect a W-9 from them at the beginning of their employment period. If you’re one of those contractors, you can expect to receive a 1099 form to report your income at the end of the tax year.

When is a W-9 form required?

Before independent contractors, gig workers, or freelance workers begin working with a company, they must complete a W-9 form and submit it to the company.

In most cases, businesses are required to ask for this form if the independent contractor is not an employee, the payment made is part of the business (the contractor is doing work specifically for the business), and payments meet the threshold of $600 in a calendar year.

What’s the purpose of the W-9 form?

A W-9 form collects information like the taxpayer identification number (TIN), employee name, and address. Providing a correct taxpayer identification number is important — it helps the IRS determine who the taxpayer is.

Some TIN examples include a social security number (SSN), employer identification number (EIN), and individual taxpayer identification number (ITIN).

How to get a W-9 form

IRS forms can be downloaded from the IRS.gov website. You can find the Form W-9 here. Always be sure you navigate to the official IRS website — don’t leave it up to your search engine.

How to fill out a W-9 form

The W-9 Form is in three parts. If you get lost, the form itself has general instructions at the bottom.

Part I: Provide your personal information

Name (Line 1):

Enter your full legal name as it appears on your tax return.

Business name (Line 2):

Only fill this out if you’re doing business under a different name than your legal name provided in Line 1 (like an LLC or sole proprietorship with a business name).

Federal tax classification (Line 3):

Check the appropriate box:

- Individual/sole proprietor

- C corporation

- S corporation

- Partnership

- Trust/estate

- Limited liability company (LLC) — check the box and write the classification (e.g., “C”, “S”, or “P”)

Exemptions (Line 4):

Skip this unless you know you’re exempt from backup withholding or FATCA reporting. Most individuals leave this blank.

Address (Lines 5 and 6):

Fill in your mailing address (street, city, state, ZIP). This is where your 1099 form will be sent.

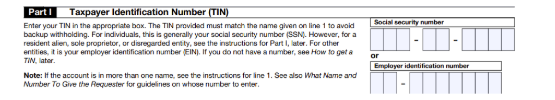

Part II: Provide your Taxpayer Identification Number (TIN)

Social Security Number (SSN):

Most individuals use their SSN.

OR

Employer Identification Number (EIN):

If you’re a business entity, you might use your EIN instead.

Only one of these needs to be filled in — either SSN or EIN, depending on how you file your taxes.

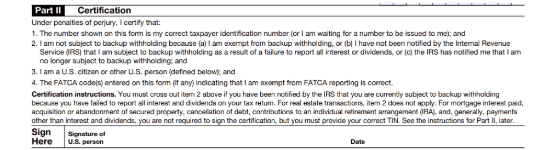

Part III: Provide your signature

Sign and date the form to certify that all the information is correct.

Your signature confirms you’re a U.S. person (citizen or resident alien) and that you’re not subject to backup withholding unless you’ve been notified otherwise by the IRS.

When you finish filling out the form, give it to the person or company requesting it. Don’t send the W-9 to the IRS.

What’s the difference between a W-9, a W-2, a W-4, and a 1099?

A worker with W-9 status will not have income taxes withheld from their payments. The employer will report the amount paid to the IRS and it’s up to the worker to pay the required taxes.

More traditional employees will fill out a W-4 at the start of their employment. This form collects information used to calculate tax withholding (the amount of income tax that an employer withholds from an employee’s paycheck).

A W-2 is sent to traditional employees at the end of the tax year and includes pay records that the employee uses to complete a tax return.

A 1099 form is used to report nonemployment income to the IRS, including income made as a freelance worker, money from a payment app like Venmo and PayPal, and interest earned from a bank.

| Form | Who fills it out | Used by | Purpose | Goes to IRS? |

| W-9 | Contractor/ vendor | Payer | Provide TIN for 1099 | No |

| W-2 | Employer | Employee | Report wages/taxes paid | Yes |

| W-4 | Employee | Employer | Set tax withholding | No |

| 1099 | Payer (client) | Contractor | Report nonemployee income | Yes |

What do employers do with W-9 forms?

When an independent contractor or freelancer fills out a W-9 and sends it to their employer, the employer uses it to prepare a Form 1099-NEC if necessary. The employer will also keep it on file for tax records in the event of an IRS audit.

How can I more easily manage my employees’ W-2s and other tax forms?

Many companies still manage IRS paperwork manually, filing paper copies with sensitive information, and relying on USPS to get important information to the IRS each year. If that sounds like you, there’s an easier way. Automating paperwork like W-2s and 1099s is a more reliable, efficient, and error-proof way to manage important employee documentation.

Avalara 1099 & W-9 is a powerful tax automation solution that makes it easier to collect, manage, and e-file IRS forms — 1099s, W-9s, W-8s, and more. It allows you to store vendor and freelancer information (while performing real-time taxpayer identification number matching with the IRS), import 1099 payee data, and transfer vendor details for quick turnaround — while automatically checking for errors.

Your competitors live by this annual report

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.