What is Texas franchise tax?

If you do business in Texas, you’ve probably heard of franchise tax. But you may not know exactly what the Texas franchise tax is — or if it applies to you.

This blog post and Texas franchise tax FAQ will answer the following questions:

Is Texas franchise tax the same as sales tax?

How is Texas franchise tax calculated?

What are the Texas franchise tax rates?

What is the “no tax due threshold”?

How do I file a franchise tax report in Texas?

Do online sellers need to pay Texas franchise tax?

Does franchise tax apply to marketplace facilitators or marketplace sellers?

What is franchise tax?

The term franchise tax may inspire thoughts of franchises, but a franchise tax has nothing to do with franchising, per se.

A “franchise” is the right or license granted to an individual or group to market a company’s goods or services. It’s also a business granted such a right or license. Your local McDonald’s is probably a franchise, because 90% of McDonald’s restaurants are franchises. Other well-known franchises include Ace Hardware locations, RE/MAX real estate businesses, and The UPS Store centers.

A franchise tax is a type of tax imposed on a taxable entity doing business in a state. It can apply to all sorts of businesses, including but not limited to franchises.

Specific franchise tax requirements vary by state. Some states call their franchise tax a privilege tax: Per the Texas Comptroller, “The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.”

For simplicity’s sake, we’ll focus on Texas franchise tax in this article.

Is Texas franchise tax the same as sales tax?

Franchise tax is not the same as sales tax. In fact, it’s more akin to a corporate income tax. Texas has both a sales tax and a franchise tax. There’s no personal income tax in Texas.

One key difference between sales tax and franchise tax, and there are many, is liability. The Texas sales tax is something a business must collect from a Texas consumer and only affects businesses that sell taxable property or services. The Texas franchise tax is a tax on doing business in the state and applies to taxable entities regardless of the type of business. It isn’t intended to be passed on to a third party. The two taxes are structurally different.

Furthermore, Texas franchise tax is a statewide tax and there are no local franchise taxes. There’s a statewide sales tax too — the base state sales tax rate in Texas is 6.25% — but most jurisdictions add a local sales tax and/or a special district sales tax. As a result, combined sales tax rates vary from location to location. (Some remote sellers can apply to collect a single local use tax rate for all transactions in Texas, but that doesn’t change the fundamental differences between the franchise tax and sales tax.)

According to the Texas Comptroller, the franchise tax is “Texas’ primary tax on businesses.” For the most part, if you’re required to collect and remit Texas sales tax, you’d also have a Texas franchise tax obligation. Yet if you make no taxable sales in the state, you likely wouldn’t need to register for sales tax even though you may need to pay the franchise tax.

Who pays Texas franchise tax?

Businesses rather than individuals are liable for franchise tax: The legal formation of an entity rather than the entity’s treatment for federal income tax purposes dictates whether the entity must pay the Texas franchise tax. Taxable entities formed in Texas must file and pay Texas franchise tax. Taxable entities that were formed elsewhere but do business in Texas may also be liable for franchise tax in Texas.

Taxable entities liable for Texas franchise tax include, but aren’t limited to:

- Banks and state limited banking associations

- Business associations

- Corporations

- Joint ventures

- Limited liability companies (LLC), including series LLCs

- Partnerships (general, limited, and limited liability)

- Professional associations and corporations

- S corporations

- Savings and loan associations

- Trusts

Other legal taxable entities may also be liable for the tax.

The following entities are among those generally not subject to franchise tax:

- Certain grantor trusts, estates of natural persons, and escrows

- Certain unincorporated passive entities

- Nonprofit self-insurance trusts created under Insurance Code Chapter 2212

- Sole proprietorships (except for single member LLCs)

- Trusts exempt under IRS code section 501(c)(9) or qualified under IRS code section 401(a)

- Unincorporated political committees

The Texas Comptroller provides a list of entities that are and aren’t subject to franchise tax and offers specific examples in its Franchise Tax FAQ. If you’re not sure whether you’re liable for Texas franchise tax, check with a trusted tax advisor.

How is Texas franchise tax calculated?

Franchise tax is based on your margins. Unless you choose to file the EZ computation report — and qualify to do so — franchise tax is computed in one of the following ways:

- Total revenue times 70%;

- Total revenue minus cost of goods sold (COGS);

- Total revenue minus compensation; or

- Total revenue minus $1 million (effective January 1, 2014).

The Texas Comptroller offers more guidance, including how to determine your compensation, COGS, and total revenue.

What are the Texas franchise tax rates?

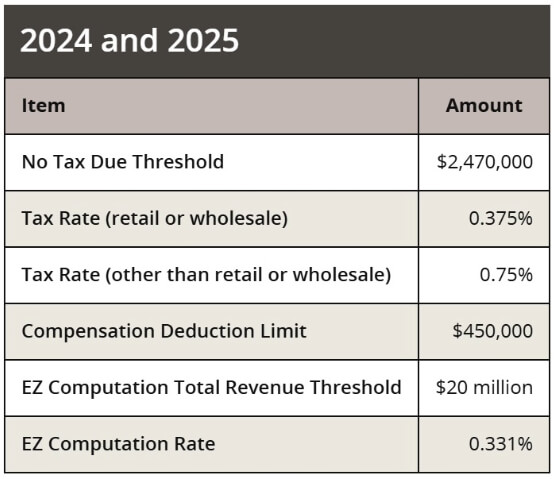

This question is trickier to answer than you might think, because franchise tax rates vary in Texas depending on your business’s annual revenue and how you report it. Moreover, franchise tax deductions, rates, and thresholds may change by report year.

Current rates, thresholds, and deduction limits for Texas franchise tax are as follows:

See the Texas Comptroller’s website for more details.

What is the “no tax due threshold”?

As you can see in the above chart, Texas has a “no tax due threshold.” If you’re the type of entity generally required to pay franchise tax but sell beneath the Texas no tax due threshold, you’re not required to pay Texas franchise tax for that period.

The Texas no tax due threshold changes every two years (on even years). It was $1.23 million for 2022–2024, then took a big leap. For franchise tax reports originally due on or after January 1, 2024, the no tax due threshold is $2.47 million.

Texas discontinued the No Tax Due Report for 2024: A taxable entity with annualized total revenue less than or equal to $2.47 million is no longer required to file a No Tax Due Report but must still file Form 05-102 or Form 05-167.

How do I file a franchise tax report in Texas?

Texas franchise tax is paid annually rather than quarterly or monthly, and it doesn’t require quarterly estimated payments. Annual franchise tax reports are due on May 15, or the next business day if that falls on a weekend or holiday.

It’s generally preferable to file a franchise tax report online through the Texas Comptroller WebFile. If online filing isn’t an option for you, you’ll find Texas franchise tax report information and instructions on the Texas Comptroller website.

Late returns are subject to penalties.

Do online sellers need to pay Texas franchise tax?

Maybe. Online sellers formed in Texas are generally required to register for Texas franchise tax. Businesses with no physical presence in the Lone Star State (i.e., remote businesses) generally need to pay franchise tax if they do a certain amount of business in the state.

As of January 1, 2020, a remote online seller is liable for Texas franchise tax if it has $500,000 or more in annual gross receipts from business in Texas. Basing a tax obligation on economic activity is known as economic nexus.

Does franchise tax apply to marketplace facilitators or marketplace sellers?

Like other business entities, a marketplace facilitator would need to register for and pay Texas franchise tax if it has a physical presence in the state or economic nexus with the state. The same goes for marketplace sellers.

Do other states have franchise tax?

Yes, indeed. Numerous states levy franchise taxes, including Arkansas, California, Delaware, Mississippi, New York, North Carolina, Tennessee, and Washington D.C. As you can see if you click on these links, some states lump franchise taxes and income taxes together on the same pages.

Bear in mind that state franchise tax requirements are subject to change. For example, Oklahoma eliminated franchise tax after tax year 2023, and there will be no corporate franchise tax in Louisiana on or after January 1, 2026.

A tax professional can help you sort out your franchise tax obligations in Texas and other states. Avalara solutions can help ensure you collect, remit, and report sales tax properly. Get in touch to learn more.

Texas franchise tax FAQs

What triggers franchise tax in Texas?

Texas imposes franchise tax on taxable entities formed in Texas or doing business in Texas.

However, some businesses are exempt from franchise tax. For instance, a qualifying new veteran-owned business is not subject to Texas franchise tax for the first five years it’s in business.

What is the purpose of franchise tax?

A franchise tax is a tax on the privilege of doing business in the state. Franchise taxes raise revenue for the states that have them.

Does a nonprofit have to pay franchise tax in Texas?

Certain nonprofits are not subject to franchise tax in Texas.

For example, a nonprofit corporation organized under the Development Corporation Act of 1979 is exempt from Texas franchise tax, as are certain nonprofit educational organizations.

Your competitors live by this annual report

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.